The details with the banks aren't agreed yet, and it isn't a total default, but no way to spin it as being anything but a declaration of bankrupcy. I'm sure the Greek people will swiftly find reason to riot over it anyway.22 July 2011 Last updated at 03:43 ET

Greece aid package boosts stock markets

The latest Greek bail-out involves a 'calculated risk' by European leaders, says the BBC's Nigel Cassidy

Stock markets have continued to rise following the eurozone's comprehensive agreement designed to resolve the Greek debt crisis.

UK, French and German markets gained more than 0.5% in early trading, while Japan's Nikkei closed up 1.2%. The euro also rose further against the dollar.

Eurozone leaders agreed a further 109bn euros ($155bn, £96.3bn) aid package.

Private lenders will contribute to the package, which will give Greece decades more to repay its debts.

The latest Greek bailout by the 17 eurozone governments and the International Monetary Fund is part of a comprehensive package to shore up the single currency unveiled on Thursday.

Eurozone leaders hailed the comprehensive agreement.

Dutch Prime Minister Mark Rutte said: "We have sent a clear signal to the markets by showing our determination to stem the crisis and turn the tide in Greece, thereby securing the future of the savings, pensions and jobs of our citizens all over Europe".

Debt relief

“Start Quote

Doubts will remain as to whether, having won a second bail-out, Greece will remain committed to unpopular austerity measures and privatisations”

End Quote

* Europe's big deal

The Institute of International Finance - a global trade body representing big banks and other major lenders - said the planned debt restructuring would target participation by 90% of Greece's private sector lenders.

French President Nicolas Sarkozy said private lenders will contribute a total of 135bn euros of financing to Greece.

The plan is expected to provide some 50bn euros of debt relief to Greece.

Three of the four options offered to lenders to swap or relend existing debts would extend Greece's repayment terms by 30 years, while the fourth would do so by 15 years.

They all offer a much lower interest rate than Greece's current 15%-25% cost of borrowing in financial markets.

Two of the options would also involve "haircuts" - reducing the amount of debt Greece has to repay.

The terms of the deal imply a loss to Greece's lenders equivalent to 21% of the market value of their debts, said the IIF.

First default

The restructuring is widely expected to be declared by credit rating agencies to be a default by Greece on its debts - something European leaders have been at pains to avert until now.

Herman Van Rompuy: "This situation was... threatening the stability of the eurozone"

The ECB and France had been particularly opposed to a default, but it was ultimately insisted on by Germany.

German Chancellor Angela Merkel said: "I strongly welcome the voluntary contribution from the banks. I believe that this is the right signal coming at a difficult time".

Mr Sarkozy played down the significance of the banks' participation in the aid package.

"If the rating agencies are using the word you just used (default), it is not part of my vocabulary. Greece will pay its debt," he told reporters.

The deal would make Greece the first ever EU country to default, and could have a number of serious repercussions:

* banks would be forced overnight to recognise in their financial accounts billions of euros in losses on Greek debts they own

* these losses could in turn leave banks short of capital - making it difficult for them to lend - and could leave the Greek banks insolvent

* Greek banks would also be unable to use their government's debts as security to borrow cash from the ECB

* the ECB itself stands to make major losses on Greek debts it has bought or accepted as collateral from the Greek banks

* separately, the debt restructuring could also trigger payouts on billions of dollars of credit derivative contracts, used by financial markets to hedge against or speculate on a Greek default

The Greek bail-out package will be used to soften the blow to the Greek banks, with 20bn euros being used to recapitalise them, and 35bn euros to facilitate their continued borrowing from the ECB.

Irish interest rates

The biggest fear of European leaders is that imposing losses on Greece's lenders could lead to contagion - a sharp increase in the rate at which markets are willing to lend to other eurozone borrowers, in particular Italy and Spain.

Continue reading the main story

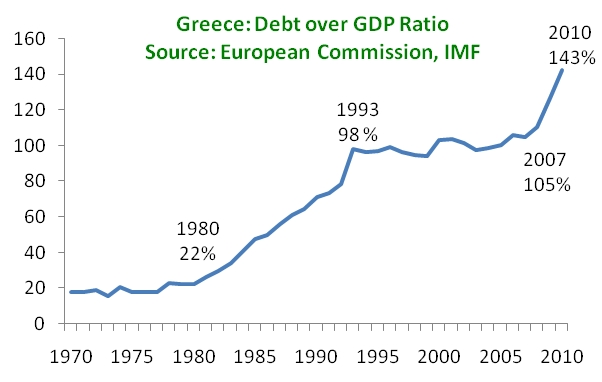

Debt to GDP ratios

* Greece 142.8%

* Italy 119%

* Belgium 96.8%

* Ireland 96.2%

* Portugal 93%

* Germany 83.2%

* France 81.7%

* Spain 60.1%

Source: Eurostat. Government debt expressed as a percentage of economic output.

"We would like to make it clear that Greece requires an exceptional and unique solution," the eurozone leaders said in a statement following their meeting.

Despite their fears, markets rallied as details of the new bail-out emerged, with the cost of borrowing for all of Europe's heavily-indebted borrowers falling.

However, the borrowing costs of Portugal and the Republic of Ireland still remain at levels that suggest markets think they too are likely to default in the next five years.

Mr Sarkozy said on Thursday there will be no imposition of losses on private sector lenders to the Irish Republic or Portugal.

Thursday's announcement should make life easier for both countries, with the repayment dates of their rescue loans being doubled to 15 years.

It also included a 2% reduction in the Irish Republic's interest payments, something that the Republic's Prime Minister, Enda Kenny said would save it a "substantial" 600-800m euros a year.

Investment projects

Among the other changes announced on Thursday were plans to ultimately turn the Eurozone's bail-out fund into a European equivalent of the IMF.

The EFSF was granted new powers to buy up bonds - necessary for it to carry out the Greek debt restructuring - and to make credit available to countries such as Spain and Italy that are not at immediate risk of insolvency.

EU development funds and loans from the European Investment Bank would be used to finance Greek infrastructure and development projects.

The move responds to criticisms from some economists that the eurozone's previous approach of insisting that Greece implement deeper and deeper budget cuts was killing the Greek economy, and therefore self-defeating.

European Commission President Jose Manuel Barroso also indicated plans to rein in the power of the credit rating agencies.

"We... endorsed the plan of reducing overreliance on external credit ratings," he said, adding that policymakers would come forward in the autumn "with further proposals".

Greek Default Ahoy!

Moderators: Alyrium Denryle, Edi, K. A. Pital

- Sea Skimmer

- Yankee Capitalist Air Pirate

- Posts: 37390

- Joined: 2002-07-03 11:49pm

- Location: Passchendaele City, HAB

Greek Default Ahoy!

http://www.bbc.co.uk/news/business-14246787

"This cult of special forces is as sensible as to form a Royal Corps of Tree Climbers and say that no soldier who does not wear its green hat with a bunch of oak leaves stuck in it should be expected to climb a tree"

— Field Marshal William Slim 1956

— Field Marshal William Slim 1956

- K. A. Pital

- Glamorous Commie

- Posts: 20813

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: Greek Default Ahoy!

Herman Van Rompuy: "This situation was... threatening the stability of the eurozone"

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali

Re: Greek Default Ahoy!

^Yes yes, the bad EU is doing it all because they just discovered they actually hate Greece.

Got anything constructive to contribute?

Got anything constructive to contribute?

Whoever says "education does not matter" can try ignorance

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

- K. A. Pital

- Glamorous Commie

- Posts: 20813

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: Greek Default Ahoy!

I think I already detailed my objections to the EU attitude towards Greece and to the complete and utter ignorance of their prior actions towards Greece, which included the foistering and benefitting from the same Greece corruption they're now blaming every hour. And my objections to the already-transpired and still continuing bailouts. Entering the Eurozone, by the way, has brought Greece almost nothing if we gouge by mere economic growth - it was growing with the same tempos in the 5 years or so.Thanas wrote:^Yes yes, the bad EU is doing it all because they just discovered they actually hate Greece.

Got anything constructive to contribute?

It would have been better to allow Greece to default, by the way, than infringe on their sovereignity. Infringements on sovereignity, even the most well-intended, generate problems down the road. Which I'm sure Europe will yet see.

In any case the current restructuring effectively requires a lot of debt pardoning. If you were going that road, you might have pardoned the entire debt, as some have suggested.

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali

Re: Greek Default Ahoy!

For people who think the Greeks are being screwed over, it's worth remembering, even with all of their austerity measures they are still running a primary budget deficit. This means that before any debt repayments are taken into account, the government is still spending more than it receives. In other words they continue to live beyond their means.Thanas wrote:^Yes yes, the bad EU is doing it all because they just discovered they actually hate Greece.

Got anything constructive to contribute?

It doesn't seem like a bad plan to me. Greece is bankrupt and basically nothing except choosing to pay for their profligacy forever would prevent an eventual default. Offering to swap Greek debt for Eurobonds at a discount is probably a good way of dealing with the problem. No way should those that lent to Greece be able to get full face value for their debts, but equally we simply can't afford for the financial system to be brought to a crashing halt once again.

Re: Greek Default Ahoy!

How is it that merely offering a loan to Greece - which Greece has no obligation to accept - infringes on their sovereignty?Stas Bush wrote:It would have been better to allow Greece to default, by the way, than infringe on their sovereignity. Infringements on sovereignity, even the most well-intended, generate problems down the road. Which I'm sure Europe will yet see.

Re: Greek Default Ahoy!

It is not unusual for countries to exhibit large low level growth and then lesser high level growth. This proves nothing.Stas Bush wrote:I think I already detailed my objections to the EU attitude towards Greece and to the complete and utter ignorance of their prior actions towards Greece, which included the foistering and benefitting from the same Greece corruption they're now blaming every hour. And my objections to the already-transpired and still continuing bailouts. Entering the Eurozone, by the way, has brought Greece almost nothing if we gouge by mere economic growth - it was growing with the same tempos in the 5 years or so.Thanas wrote:^Yes yes, the bad EU is doing it all because they just discovered they actually hate Greece.

Got anything constructive to contribute?

Because screwing over the greek pensioners, elderly and poor is a better option?It would have been better to allow Greece to default, by the way, than infringe on their sovereignity. Infringements on sovereignity, even the most well-intended, generate problems down the road. Which I'm sure Europe will yet see.

How is Europe going to manage that?In any case the current restructuring effectively requires a lot of debt pardoning. If you were going that road, you might have pardoned the entire debt, as some have suggested.

Whoever says "education does not matter" can try ignorance

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

Re: Greek Default Ahoy!

Didn't you once claim that Germany alone could continue the bailouts indefinitely if required, even if it cost a trillion Euros? There's currently around €285 billion of Greek debt outstanding, wouldn't it then, be well within your means to forgive the entirety of Greece's debts? We, being civilized Europeans, shall buy out and forgive all that Greece owes as a show of our kindness and enlightened nature.Thanas wrote:How is Europe going to manage that?Stas Bush wrote:n any case the current restructuring effectively requires a lot of debt pardoning. If you were going that road, you might have pardoned the entire debt, as some have suggested.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

- Starglider

- Miles Dyson

- Posts: 8709

- Joined: 2007-04-05 09:44pm

- Location: Isle of Dogs

- Contact:

Re: Greek Default Ahoy!

That isn't my interpretation of recent events, or more relevantly what I hear from fixed income traders I work with. What seems to be happening is a dog and pony show to hide a massive expansion in the size and role of the EFSF, which will now engage in large scale stealth monetisation similar to what the US Federal Reserve has been doing for the last two years. This will be combined with mechanisms that boil down to a blanket loan guarantee of peripheral debt (sovereign and to some extent private banks) from France and Germany. There may be some token 'haircut' gestures but nothing meaningful given the ridiculous terms on which the ECB will repurchase bad debt and stealth recapitalise any and all banks that should have been damaged by holding peripheral debt. The sentiment on the trading floor three months ago seemed to be that the EU leaders would lie and spin and melodramatically play act to a greater degree than ever before, but ultimately submit to some combination of mindless optimism, arrogance and short term realpolitik, and just bail-out all needy parties indefinitely, with a layer of financial engineering bullshit to try and hide this from the voters. As far as I can tell, this prediction is playing out.Sea Skimmer wrote:The details with the banks aren't agreed yet, and it isn't a total default, but no way to spin it as being anything but a declaration of bankrupcy. I'm sure the Greek people will swiftly find reason to riot over it anyway.

The economies of the eurozone countries are effectively being hog-tied together and joint sovereign eurobonds are being implemented in practice if not in name. In the short term this will be good for everyone as the periphery can go back to borrowing and spending like it's 1999, or at least 2006. In the medium term it will comprehensively trash the Euro, much moreso than letting the periphery default now would, which will cause even more inflation in commodities and imports, but the dollar will probably be cratering as well and at least German exporters will be happy. In the long term it will destroy the eurozone in a massive co-ordinated crash, some nasty combination of massive austerity, inflation and countries bailing out to print their debt away. The first stage is evidenced by the relaxing sovereign CDS spreads on the periphery (which were at all time highs prior to this announcement) combined with the CDS spreads on France and Germany creeping up. Confirmation should come in the next month of sovereign bond auctions.

Unless of course you agree with these politicians that a massive pent-up economic boom is just around the corner, just waiting to be unleashed by a bit more public sector spending.

- Rogue 9

- Scrapping TIEs since 1997

- Posts: 18670

- Joined: 2003-11-12 01:10pm

- Location: Classified

- Contact:

Re: Greek Default Ahoy!

And with Greece still running a massive budget deficit without any sort of productive economy to back it up, they'd be right back at it again within the decade.J wrote:Didn't you once claim that Germany alone could continue the bailouts indefinitely if required, even if it cost a trillion Euros? There's currently around €285 billion of Greek debt outstanding, wouldn't it then, be well within your means to forgive the entirety of Greece's debts? We, being civilized Europeans, shall buy out and forgive all that Greece owes as a show of our kindness and enlightened nature.Thanas wrote:How is Europe going to manage that?Stas Bush wrote:n any case the current restructuring effectively requires a lot of debt pardoning. If you were going that road, you might have pardoned the entire debt, as some have suggested.

It's Rogue, not Rouge!

HAB | KotL | VRWC/ELC/CDA | TRotR | The Anti-Confederate | Sluggite | Gamer | Blogger | Staff Reporter | Student | Musician

HAB | KotL | VRWC/ELC/CDA | TRotR | The Anti-Confederate | Sluggite | Gamer | Blogger | Staff Reporter | Student | Musician

- K. A. Pital

- Glamorous Commie

- Posts: 20813

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: Greek Default Ahoy!

So how is the current plan going to help Greece get any "productive economy"?Rogue 9 wrote:And with Greece still running a massive budget deficit without any sort of productive economy to back it up, they'd be right back at it again within the decade.

Considering that people said Greece is unproductive and lost its productive base during its Euro-integration, that's a tacit admission that the economic growth of Greece in the Eurozone has been fictitious. It is not unusual for growth to moderate, but it seems that there was no moderation as you say. Which means you also admit to what's been said above: the so-called "growth" of Greece in the Eurozone was an unsustainable credit bubble. If you admit this, then do tell me what are those "benefits" of the Eurozone for Greece, outside of that malinvestment and paper growth? Loss of sovereignity and cuts after years of unsustainable spending and cheap borrowing from Franco-Swiss private creditors? Are these the great gifts bestowed by Europe on its lesser members?Thanas wrote:It is not unusual for countries to exhibit large low level growth and then lesser high level growth. This proves nothing.

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali

Re: Greek Default Ahoy!

Tourism, which is about the only thing Greece currently has going for them. Funding for their culture. Investment. Access to a market for their agricultural process. Outflagging.Stas Bush wrote:Considering that people said Greece is unproductive and lost its productive base during its Euro-integration, that's a tacit admission that the economic growth of Greece in the Eurozone has been fictitious. It is not unusual for growth to moderate, but it seems that there was no moderation as you say. Which means you also admit to what's been said above: the so-called "growth" of Greece in the Eurozone was an unsustainable credit bubble. If you admit this, then do tell me what are those "benefits" of the Eurozone for Greece, outside of that malinvestment and paper growth?

Whoever says "education does not matter" can try ignorance

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

- K. A. Pital

- Glamorous Commie

- Posts: 20813

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: Greek Default Ahoy!

So Greece was turned into Europe's tourist backyard, sort of a Thailand-closer-to-home (without the fucking for food and malnourished villagers selling their bodies, obviously)? That's the great benefit? Funding for their culture? I heard they had transportation funding from the EU, but I never heard about the EU funding "Greek culture". And Greek naval policy had its good and bad days even without belonging to the Eurozone, not sure the impact can be adequately evaluated here. Needless to remind that the main benefits everybody noted prior to 2007-2008 were "easier lending". In fact, there's quite a few studies (e.g. Kallianiotis study on Greece pre- and post-ascension) which dispute the beneficiality of EMU joining for Greece. Are they all bunk? Did you just decide they're bunk without reading?Thanas wrote:Tourism, which is about the only thing Greece currently has going for them. Funding for their culture. Investment. Access to a market for their agricultural process. Outflagging.

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali

Re: Greek Default Ahoy!

Stas Bush wrote:So Greece was turned into Europe's tourist backyard, sort of a Thailand-closer-to-home (without the fucking for food and malnourished villagers selling their bodies, obviously)?

Guess whose revenue goes directly towards funding Greek museums and the like?That's the great benefit? Funding for their culture? I heard they had transportation funding from the EU, but I never heard about the EU funding "Greek culture".

Obviously, you prefer the EU-less nations around Greece. What freaking models of prosperity and democracy they are, right? But hey, if you prefer with the state of Greece before it joined the EU, then pray tell me if the EU helping develop democracy in that country back then was a net negative or net positive?And Greek naval policy had its good and bad days even without belonging to the Eurozone, not sure the impact can be adequately evaluated here. Needless to remind that the main benefits everybody noted prior to 2007-2008 were "easier lending". In fact, there's quite a few studies (e.g. Kallianiotis study on Greece pre- and post-ascension) which dispute the beneficiality of EMU joining for Greece. Are they all bunk? Did you just decide they're bunk without reading?

Whoever says "education does not matter" can try ignorance

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

- K. A. Pital

- Glamorous Commie

- Posts: 20813

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: Greek Default Ahoy!

Considering my own nation is a cesspool of modern slavery and human trade, I see no reason why I wouldn't characterize it like that, or how that constitutes any hatred of anything on my part. Other than hatred of the above-mentioned practices. Which, by the way, exist in Greece and despite legalized prostitution, only 1 in 20 is legal, the rest are victims of slavery and human trade and abuse, their numbers can be as high as twenty thousand.Thanas wrote:Your sheer hatred for anything western is probably the only reason why you would characterize it like that.

Were Greek museums substantially worse off before the joined the EMU, though?Thanas wrote:Guess whose revenue goes directly towards funding Greek museums and the like?

EMU-less nations around and inside the EU are not all complete and utter wrecks you're painting them to be. Sweden, Norway and Britain are not in any hellish condition because they held their own currencies. But hey, I must be particularly evil and anti-Euro because I have noted that joining the EMU is not, in fact, necessary to be on good terms or even to be inside the European Union. And you're lambasting me?Thanas wrote:Obviously, you prefer the EU-less nations around Greece.

You seem to be completely unable to separate Greece joining the EU (1982) and the EMU (2001) and installing Euro as a currency, which is not a requirement to be in the EU or the European Economic whatever-Area like Norway did. I refuse to argue on such terms.Thanas wrote:But hey, if you prefer with the state of Greece before it joined the EU, then pray tell me if the EU helping develop democracy in that country back then was a net negative or net positive?

If you want to cram the Euro down everybody's throat, be consistent and kick out and stop cooperating with Britain, Norway and Sweden. And teach those Hungary idiots that they have to set a date when they abolish the HUF and take up the glorious Euro. No Euro - no European Union friendship, is that correct?

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali

Re: Greek Default Ahoy!

And I'll bet that somehow is the EU's fault as well.Stas Bush wrote:Considering my own nation is a cesspool of modern slavery and human trade, I see no reason why I wouldn't characterize it like that, or how that constitutes any hatred of anything on my part. Other than hatred of the above-mentioned practices. Which, by the way, exist in Greece and despite legalized prostitution, only 1 in 20 is legal, the rest are victims of slavery and human trade and abuse, their numbers can be as high as twenty thousand.

Before 2001? Depends. Before joining the EU? Yes.Were Greek museums substantially worse off before the joined the EMU, though?I'm not sure.

Considering that apparently all bad things are due to the Euro and the evil European smurfs forcing the bailouts down the throats of poor little Greece, infringing on their sovereignty every way (ironic, since you are also fond of arguing in favor of cleaning up greece which would violate sovereignty even worse) and obviously the EU is a tool of bankers and the Euro the chief instrument for debt slavery, I have no doubt that somehow you manage to gloss over the fact that joining the EMU is necessary for further EU integration.EMU-less nations around and inside the EU are not all complete and utter wrecks you're painting them to be. Sweden, Norway and Britain are not in any hellish condition because they held their own currencies. But hey, I must be particularly evil and anti-Euro because I have noted that joining the EMU is not, in fact, necessary to be on good terms or even to be inside the European Union. And you're lambasting me?

The only way to do that is to infringe on their national sovereignty. Oops.If you want to cram the Euro down everybody's throat, be consistent and kick out and stop cooperating with Britain, Norway and Sweden.

Considering the Euro is already a second currency over there (or at least is in Budapest) I fail to see your point here.And teach those Hungary idiots that they have to set a date when they abolish the HUF and take up the glorious Euro. No Euro - no European Union friendship, is that correct?

Whoever says "education does not matter" can try ignorance

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

- K. A. Pital

- Glamorous Commie

- Posts: 20813

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: Greek Default Ahoy!

I specifically said that benefits from joining the EMU were rather unclear, whereas benefits from being on good terms or even entering the EU were more than obvious. A bankrupt tourist destination and nothing more is how people in Europe now see Greece. Was this degradation entirely their fault?Thanas wrote:And I'll bet that somehow is the EU's fault as well.

Which is exactly my point. Joining the EMU and joining the EU are completely different things.Thanas wrote:Before 2001? Depends. Before joining the EU? Yes.

So the current level of integration is not enough? What if further integration proves counterbeneficial?Thanas wrote:Considering that apparently all bad things are due to the Euro and the evil European smurfs forcing the bailouts down the throats of poor little Greece, infringing on their sovereignty every way (ironic, since you are also fond of arguing in favor of cleaning up greece which would violate sovereignty even worse) and obviously the EU is a tool of bankers and the Euro the chief instrument for debt slavery, I have no doubt that somehow you manage to gloss over the fact that joining the EMU is necessary for further EU integration.

So you admit that you can't really force them to take on the Euro, and that they aren't really much worse off for ignoring the Euro. And you then say that Greece shouldn't wonder if their policitians did the right thing in 2001 when they took on the Euro?Thanas wrote:The only way to do that is to infringe on their national sovereignty. Oops.

My point is that some nations ignored the Euro and didn't horribly die from some sort of Eurocurse. Whereas the whole affair with the weaker EU nations who ascended to the EMU looks like a bad gamble. On part of everyone, except of course the bankers and officials who are bailed out every time this shit is happening.Thanas wrote:Considering the Euro is already a second currency over there (or at least is in Budapest) I fail to see your point here.

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali

Re: Greek Default Ahoy!

The main reason that Greece is in trouble is that their economy is utterly unable to compete on the global market. More than 70% of their economy is in the tertiary sector. Plenty of that is owned by the government, and the rest depends on importing capital from other countries via tourism, banking and their shipping sector.

Being part of the Eurozone might worsen those problems now, but it is not the cause for them. Furthermore, Greece would not gain the massive financial backup it's gets now if it was not part of the Eurozone.

Being part of the Eurozone might worsen those problems now, but it is not the cause for them. Furthermore, Greece would not gain the massive financial backup it's gets now if it was not part of the Eurozone.

SoS:NBA GALE Force

"Destiny and fate are for those too weak to forge their own futures. Where we are 'supposed' to be is irrelevent." - Sir Nitram

"The world owes you nothing but painful lessons" - CaptainChewbacca

"The mark of the immature man is that he wants to die nobly for a cause, while the mark of a mature man is that he wants to live humbly for one." - Wilhelm Stekel

"In 1969 it was easier to send a man to the Moon than to have the public accept a homosexual" - Broomstick

Divine Administration - of Gods and Bureaucracy (Worm/Exalted)

"Destiny and fate are for those too weak to forge their own futures. Where we are 'supposed' to be is irrelevent." - Sir Nitram

"The world owes you nothing but painful lessons" - CaptainChewbacca

"The mark of the immature man is that he wants to die nobly for a cause, while the mark of a mature man is that he wants to live humbly for one." - Wilhelm Stekel

"In 1969 it was easier to send a man to the Moon than to have the public accept a homosexual" - Broomstick

Divine Administration - of Gods and Bureaucracy (Worm/Exalted)

- K. A. Pital

- Glamorous Commie

- Posts: 20813

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: Greek Default Ahoy!

It may have not defaulted in the first place if it did not join the Euro as Greek banks and the government itself would not be able to borrow at very low rates, entirely forgetting about necessary reserve for currency risks - which Greece had prior to 2001, you know, and it was a rather substantial reserve considering the fluctuations of the drahma. To make it more clear, Greek reserves went from ~20 billion Euro to almost zero after the currency swap.

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali

Re: Greek Default Ahoy!

I won't say entirely, but nobody forced them to live beyond their means.Stas Bush wrote:I specifically said that benefits from joining the EMU were rather unclear, whereas benefits from being on good terms or even entering the EU were more than obvious. A bankrupt tourist destination and nothing more is how people in Europe now see Greece. Was this degradation entirely their fault?

Not really if the goal is further integration, which has been the stated goal since at least the middle 1990s.Which is exactly my point. Joining the EMU and joining the EU are completely different things.

Yes, it is not enough. Europe has to speak with one voice.So the current level of integration is not enough? What if further integration proves counterbeneficial?I'm genuinely wondering.

Norway and Sweden are not prototypical countries either.Because like I said, Norway and Sweden do not experience some sort of catastrophy as a result of their choice to ignore the EMU and keep their own currencies.

Switzerland is not a member of the Eu, so they would not be involved anyway. And I really like how you characterize "some" (which?) European nations as the house. So basically what you are saying is that the EU should have infringed on Greece's sovereignty back then and stopped them from borrowing money, thereby making the European commission the ultimate budget authority in the EU?Yes, a lot of the bad things may be related to the Euro. For example, the ability of the corrupt Greek government and their private institutions to endlessly borrow in an "optimistic" atmosphere with very low and stable rates undeniably was related to EMU ascension. Take any paper from 2007 and you'll see how Greece squandered all their reserves immediately after getting the Euro as a currency. And I won't even repeat that "cleaning Greece up" by the same people whose banks were engaged in crazy post-crisis lending to Greece - like France and Switzerland - with no consequences, absolutely raises suspicions. And it rightfully should. Greek government may be a gambler, and they're corrupt assholes. But what of some European nations? They're the house, then, and how is that even good if the house would start managing the affairs of a gambler?

No, I made not comment on the latter part, no matter how you wish I did (and in such a manner that is soooo very friendly to your position, my my). That said, countries that have not taken on the Euro also suffered a lot, like the British export market suffering due to the high pound etc. So I am not going to go down this road and become the arbiter of what country benefitted or not.So you admit that you can't really force them to take on the Euro, and that they aren't really much worse off for ignoring the Euro.

They may wonder but it does not matter with regards to the current problem as sheer anti-Euro is no solution.And you then say that Greece shouldn't wonder if their policitians did the right thing in 2001 when they took on the Euro?

For every Greece, there are at least three "weaker" nations who gained from it. The Baltics for example.My point is that some nations ignored the Euro and didn't horribly die from some sort of Eurocurse. Whereas the whole affair with the weaker EU nations who ascended to the EMU looks like a bad gamble. On part of everyone, except of course the bankers and officials who are bailed out every time this shit is happening.

It is neither the fault of the EU nor the fault of the Eurozone that Greece became stupid.

Whoever says "education does not matter" can try ignorance

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

Re: Greek Default Ahoy!

Borrowing less money would have only resulted in Greece being poorer. They borrowed most of that money to improve their standard of living via tax breaks, well-paid government jobs and generous welfare and pensions.

Without all those loans, the standard of living would have been much lower.

What Greece SHOULD have done with those loans is investment into infrastructure and modernization of their industry. And while the EU should have looked at what they did with their money, that'd be infringement of sovereignty

Now the question is what Greece would look like without the ability to loan plenty of money. My guess is simply that their standard of living would be much lower, and get gradually worse and worse simply because their industry is not competitive.

Without all those loans, the standard of living would have been much lower.

What Greece SHOULD have done with those loans is investment into infrastructure and modernization of their industry. And while the EU should have looked at what they did with their money, that'd be infringement of sovereignty

Now the question is what Greece would look like without the ability to loan plenty of money. My guess is simply that their standard of living would be much lower, and get gradually worse and worse simply because their industry is not competitive.

SoS:NBA GALE Force

"Destiny and fate are for those too weak to forge their own futures. Where we are 'supposed' to be is irrelevent." - Sir Nitram

"The world owes you nothing but painful lessons" - CaptainChewbacca

"The mark of the immature man is that he wants to die nobly for a cause, while the mark of a mature man is that he wants to live humbly for one." - Wilhelm Stekel

"In 1969 it was easier to send a man to the Moon than to have the public accept a homosexual" - Broomstick

Divine Administration - of Gods and Bureaucracy (Worm/Exalted)

"Destiny and fate are for those too weak to forge their own futures. Where we are 'supposed' to be is irrelevent." - Sir Nitram

"The world owes you nothing but painful lessons" - CaptainChewbacca

"The mark of the immature man is that he wants to die nobly for a cause, while the mark of a mature man is that he wants to live humbly for one." - Wilhelm Stekel

"In 1969 it was easier to send a man to the Moon than to have the public accept a homosexual" - Broomstick

Divine Administration - of Gods and Bureaucracy (Worm/Exalted)

- K. A. Pital

- Glamorous Commie

- Posts: 20813

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: Greek Default Ahoy!

The generic neoliberal consensus about credit-fuelled expansion of consumption was prevalent in Europe as well. Some nations kept their government books better than others, that is true. A great many did not.Thanas wrote:I won't say entirely, but nobody forced them to live beyond their means.

*eyes suspiciously* What's that, some sort of bad superpower dream? Europe has to? Who said that? You're ready to force people? Does one voice include one language as well? Why not introduce mandatory English for all citizens, then? That would greatly help "further integration"! You can end up with abolition of national governments and installing direct control from Brussels, leaving the borders a mere formality. That will also help further integration. I thought Europe was a confederacy friendly to neighbors, regardless if they take or their currency or not.Thanas wrote:Not really if the goal is further integration, which has been the stated goal since at least the middle 1990s. ... Yes, it is not enough. Europe has to speak with one voice.

But I see. Your is the vision of a new benevolent collective colonizer. The destruction of some nations' sovereignity is beneficial, because it helps to bring about the vision of a United Europe!

Neither is Greece "prototypical" or typical at all. All Euro nations had their unique traits. But I see. Some are more equal than others.Thanas wrote:Norway and Sweden are not prototypical countries either.

Maybe the EU should have stopped Greece from borrowing - or lenders from lending, or the bailout hysteria from spreading at a time when it was still possible to avoid the issue of private defaults becoming national defaults. But since you did not do that, it seems the question is now moot on whether you should have done it. By the way, when Europe discovered that Athens hid some ~1 billion of expenses and therefore deficit in 2004 or so, you did what...? That's right. Nothing.Thanas wrote:Switzerland is not a member of the Eu, so they would not be involved anyway. And I really like how you characterize "some" (which?) European nations as the house. So basically what you are saying is that the EU should have infringed on Greece's sovereignty back then and stopped them from borrowing money, thereby making the European commission the ultimate budget authority in the EU?

British exports suffered, but Britain had no sovereign default - yet. And even if it has a default in the future, that shit would be the fault of British idiots who bailed out the banks and continued to borrow and throw cash in vain hopes of "economic recovery" while chanting crazy neoclassical and neokeynesian mantras.Thanas wrote:No, I made not comment on the latter part, no matter how you wish I did (and in such a manner that is soooo very friendly to your position, my my). That said, countries that have not taken on the Euro also suffered a lot, like the British export market suffering due to the high pound etc. So I am not going to go down this road and become the arbiter of what country benefitted or not.

If they default, a national currency may soften the fall. Who knows. I'm not sure any of the weaker Euro nations really benefitted from the EMU at all. All of them are now under serious threat of bankrupcy.Thanas wrote:They may wonder but it does not matter with regards to the current problem as sheer anti-Euro is no solution.

You got to be kidding me, Thanas. Greece is more people than all three Baltic nations combined. Besides, none of the Baltics except Estonia introduced the Euro, and Estonia only did it recently. You've got to be kidding me. All weaker Euro nations were screwed royally.Thanas wrote:For every Greece, there are at least three "weaker" nations who gained from it. The Baltics for example.

Your examples above show that non-EMU nations actually fared better, according to your own words (!) than weak EMU nations - Hungary, Estonia, etc. all who had national currencies during 2000-2008, as opposed to having the Euro, have "benefitted". Greece, Portugal, Ireland, Italy, Spain - all those are screwed. Who is grasping at straws here again?Thanas wrote:It is neither the fault of the EU nor the fault of the Eurozone that Greece became stupid.

I'm not sure Greek wages changed as much as Greek corporation profits during 2001-2010. So it is not the ordinary people who squandered the bulk of these funds.Serafina wrote:Borrowing less money would have only resulted in Greece being poorer. They borrowed most of that money to improve their standard of living via tax breaks, well-paid government jobs and generous welfare and pensions. Without all those loans, the standard of living would have been much lower.

The Greek government started recklessly borrowing and crazily throwing dozens of billions of money in 2007-2008-2009, effectively bankrupting self. During that time private entities should have DEFINETELY thought twice before lending. But hey, they got bailed out so everything is hokey dockey. Before 2007-2008, what sort of giant government EU or private EU bank loans did Greece get?Serafina wrote:What Greece SHOULD have done with those loans is investment into infrastructure and modernization of their industry. And while the EU should have looked at what they did with their money, that'd be infringement of sovereignty

Now the question is what America would look without loaning lots of money and then all that irresponsible lending blowing in their face? Maybe a static, but sustainable life standard is better than the crazy idiotic "growth at all costs" mantra supported by idiotic lending practices.Serafina wrote:Now the question is what Greece would look like without the ability to loan plenty of money. My guess is simply that their standard of living would be much lower, and get gradually worse and worse simply because their industry is not competitive.

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali

Re: Greek Default Ahoy!

So you will admit that Europe did not force Greece to live beyond its means?Stas Bush wrote:The generic neoliberal consensus about credit-fuelled expansion of consumption was prevalent in Europe as well. Some nations kept their government books better than others, that is true. A great many did not.Thanas wrote:I won't say entirely, but nobody forced them to live beyond their means.

Don't be stupid and read things into my words that are not there.*eyes suspiciously* What's that, some sort of bad superpower dream? Europe has to? Who said that? You're ready to force people?

No, my paranoid little friend. If you do not mind, I'll just skip the rest of your paranoid meltdown.Does one voice include one language as well?

....Get the heck off whatever you are smoking. You are completely wrong about everything I said.But I see. Your is the vision of a new benevolent collective colonizer. The destruction of some nations' sovereignity is beneficial, because it helps to bring about the vision of a United Europe!

Again, stop with your paranoid delusions. You somehow want to argue that the Euro did not benefit anybody but at the same time you also want to argue that Greece is special. You can't have it both ways.Neither is Greece "prototypical" or typical at all. All Euro nations had their unique traits. But I see. Some are more equal than others.Thanas wrote:Norway and Sweden are not prototypical countries either.

Actually, you'll find that Europe did everything it could without infringing upon the sovereignty of that nation. But suddenly you do not care about that, eh? Who's the Imperialist demanding that Europe does this and that now?Maybe the EU should have stopped Greece from borrowing - or lenders from lending, or the bailout hysteria from spreading at a time when it was still possible to avoid the issue of private defaults becoming national defaults. But since you did not do that, it seems the question is now moot on whether you should have done it. By the way, when Europe discovered that Athens hid some ~1 billion of expenses and therefore deficit in 2004 or so, you did what...? That's right. Nothing.

So you admit that not joining the Eurozone has bad effects as well. And I am sure a lot British debt (the majority, I bet) is due to previous Governments.British exports suffered, but Britain had no sovereign default - yet. And even if it has a default in the future, that shit would be the fault of British idiots who bailed out the banks and continued to borrow and throw cash in vain hopes of "economic recovery" while chanting crazy neoclassical and neokeynesian mantras.

Define weaker nations and list those under threat of bankruptcy.If they default, a national currency may soften the fall. Who knows. I'm not sure any of the weaker Euro nations really benefitted from the EMU at all. All of them are now under serious threat of bankrupcy.

How nice of you to only selectively list those nations who now have problems.Your examples above show that non-EMU nations actually fared better, according to your own words (!) than weak EMU nations - Hungary, Estonia, etc. all who had national currencies during 2000-2008, as opposed to having the Euro, have "benefitted". Greece, Portugal, Ireland, Italy, Spain - all those are screwed. Who is grasping at straws here again?

Whoever says "education does not matter" can try ignorance

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

- K. A. Pital

- Glamorous Commie

- Posts: 20813

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: Greek Default Ahoy!

All EU periphery was living beyond their means. Greek default happened in 2007-2010, not beforehand. And in 1990-2001 Greek debt was at ~100% GDP as well. So Greece was "living beyond its means" for a very long while before it entered the EMU and did not substantially alter that ratio UNTIL Europe started fucking goats and singing bailout songs.Thanas wrote:So you will admit that Europe did not force Greece to live beyond its means?

Spare me the crying.

Greek debt was stable and even slightly decreased before the crisis years. So no, your position that "Greece is alone to blame for this" won't fly. Who the fuck LENDS amidst a financial crisis, anyway? But of course, that doesn't raise any bells. Sure.

Europe has to speak with one voice, sure. You just wrote that above. Explain yourself. Why is being a confederacy not enough? Because you want it to be more than that? Maybe some people don't.Thanas wrote:Don't be stupid and read things into my words that are not there.

The EMU as a whole may not have benefitted anybody. News at eleven. Sans the wealthiest nations' special interest groups - e.g. exporters when the Euro became cheaper during the recent Greek default fear, and of course the corporations which are already setting their teeth at the Greek and other weaker EU nations' assets to be given away.Thanas wrote:Again, stop with your paranoid delusions. You somehow want to argue that the Euro did not benefit anybody but at the same time you also want to argue that Greece is special. You can't have it both ways.

I'm not demanding that Europe do anything. In fact, Europe should have let Greece and the periphery default. That's the price for your EMU. That's the price for what you have been doing the last 3 years or so. Not the last TEN years, because at that time Greece wasn't at a threat of default, neither the decade before that. They were running a close to 100% GDP debt, sure, but they also had 20 billion Euros worth of reserves.Thanas wrote:Actually, you'll find that Europe did everything it could without infringing upon the sovereignty of that nation. But suddenly you do not care about that, eh? Who's the Imperialist demanding that Europe does this and that now?

Thanas wrote:So you admit that not joining the Eurozone has bad effects as well. And I am sure a lot British debt (the majority, I bet) is due to previous Governments.

Whoops. Tell me again, whose fault that is now?

Weaker nations are the EU periphery - which includes a great majority of newly ascending East European nations, and those under the threat of bankruptcy... well, PIIGS is a shit acronym, but it's correct. Latvia almost defaulted in 2009. Hungary's own government acknowleged that they cooked the books and also said they were close to defalt in mid-2010, which were BTW factors behind the neo-fascists electoral successes in Hungary. You want more?Thanas wrote:Define weaker nations and list those under threat of bankruptcy.

Actually, if you look above, my view is a bit wider than yours. I know about the problems of non-EMU nations as well (including Hungary and the Baltics, the latter being your "success" example - I'm curious how Latvia's near-default and bailout by the IMF with subsequent 23% unemployment is a "success", anyway).Thanas wrote:How nice of you to only selectively list those nations who now have problems.

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali

Re: Greek Default Ahoy!

Nobody forced them, but you can't deny that the EU enabled and arguably encouraged them to live beyond their means. I'm not forcing an alcoholic to drink by buying rum for him when he's too drunk to make it to the liquor store, but I'm definitely enabling his habit. It's the exact same idea with regards to Greece and the EU; Greece has a bad habit, you guys continue to enable it. You can't cure a debt junkie with more debt any more than you can sober up an alcoholic with another bottle of rum.Thanas wrote:I won't say entirely, but nobody forced them to live beyond their means.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker