Is a US economic implosion (aka Greece) inevitable?

Moderators: Alyrium Denryle, Edi, K. A. Pital

Re: Is a US economic implosion (aka Greece) inevitable?

Ok, so based on the inputs from others on the board, would a better solution be to continue printing money and at the same time enact budget cuts and/or tax increases that only affect the 0.1% mega rich population of America? So no reductions to entitlement programs, but restoring the tax rates during Clinton era and maybe introduce a flat rate 30% tax for those who have >1 million in income (and I am referring to both earned and unearned income). In that way jerks like Romney and uber rich dudes like Buffet would be paying their fare share of taxes and not getting away with a lower tax rate due to loopholes in the tax legislation. Then, after when the economy shows REAL signs of recovery in I dunno maybe 5 years time, enact a second phase of austerity measures that would affect everyone to ensure long-term fiscal stability (i.e. deal with the ballooning Medicare and SS)?

Re: Is a US economic implosion (aka Greece) inevitable?

I disagree with your opinion that it is fine as long as we can payoff the interest on debt. That's like paying off the minimum balance on your credit card. It's this kind of fiscally irresponsible thinking that is so ingrained in American culture and politics that has gotten us into this mess in the first place! Carrying so much debt only gives you limited room to maneuver in your finances. It's one of the reason why we are in this shit mess in the first place. Americans think they can use debt and live paycheck-to-paycheck to live beyond the means which caused the housing bubble, and the US govt and megacorporations were complicit in this act by giving out loans and credit like water.Simon_Jester wrote:You keep fixating on "debt to repay debt." Repaying debt was never the point- you take out a loan to accomplish some task, to build something or buy something, not just to make interest payments. The interest on the US's national debt is still manageable, it's not like it's a majority of the budget, and if we ever really cared about ability to make interest payments we really could raise taxes by the small amount required to make it happen.

As long as you can make interest payments, the mere fact that you are in debt is not the end of the world, and you are not "using debt to repay debt."

You may be running deficits for other reasons- say, "using debt to pay for children's education" or "using debts to pay for foreign wars" or "using debts to pay for highway construction" or "using debt to feed the unemployed." But whether things like that are sound or unsound is a totally different question.

I will not dispute that taking on some debt for constructive purposes (e.g. infrastructure development, revitalize the nuclear power industry) would be OK, but there has to be a reasonable limit and I feel that exceeding 100% of the GDP is pushing it. That's like owing as much as you earn in salary, how can one feel financially comfortable with such a situation? There has to be a limit. You don't take on debt for everything in your daily life right? You only take on a mortgage for a home but not on a laptop purchase yes? The problem with the American economy is that it is taking out debt to fund everything under the sun, from SS to Food Stamps to Bailing out Banks to Expensive Wars, and it has the attitude of "I want everything" without due consideration on the long-term financial consequences of such actions.

BOTTOMLINE: I will acknowledge that perhaps it would not be wise to cut spending across the board, but I still think it would be prudent to strategically cut spending in a manner that would not affect the lives of the majority of Americans. For example increased taxes on millionares and an immediate and complete withdrawal from Middle East and the cessation of expensive and unproductive wars would probably be a good start.

If you at these sources:

http://www.washingtonpost.com/wp-srv/sp ... o-the-red/

In was these 2 factors (tax cuts and wars) that got us into this debt mess and it seems reasonable and fair to target these 2 factors first. I don't think the economy will go into another recession simply because we stop bombing cave dwellers in the Middle East and make the 1% pay their fair share of taxes, do you?

I hope at least we can agree on this point.

-

Simon_Jester

- Emperor's Hand

- Posts: 30165

- Joined: 2009-05-23 07:29pm

Re: Is a US economic implosion (aka Greece) inevitable?

It's a question of timing.AndroAsc wrote:I disagree with your opinion that it is fine as long as we can payoff the interest on debt. That's like paying off the minimum balance on your credit card. It's this kind of fiscally irresponsible thinking that is so ingrained in American culture and politics that has gotten us into this mess in the first place! Carrying so much debt only gives you limited room to maneuver in your finances. It's one of the reason why we are in this shit mess in the first place. Americans think they can use debt and live paycheck-to-paycheck to live beyond the means which caused the housing bubble, and the US govt and megacorporations were complicit in this act by giving out loans and credit like water.

The moment you lose your sources of income, when your children are sick and the car keeps breaking down and prospects are bad? That is not the time to start spending every penny on paying off debts. Nor is it the time to pawn off valuable assets and long-term prospects to pay off the balance on a debt.

No, you should pay off debts when times are good. If you can comfortably afford to pay the interest on a debt now when times are bad, and pay off the principal when times are good, it is better than if you spend yourself into grinding poverty and burn through your savings trying to pay your debts when you have no income and massive expenses for things like medicine for your children.

We should have been paying down the debt during the 2000s, the Bush years. But instead, Bush decided to cut taxes, which guaranteed we'd be running a deficit during the good years, and left us going into the bad years with a heavy burden of debt. And now is an incredibly stupid time to start agitating for the repayment of those debts, especially if to do it you want to cut the parts of the budget that are keeping people alive and the economy running.

The fact that you only just now noticed this was a problem doesn't mean that everyone else is ignoring it, or that no one cares about solving it, or even that "solving" it the way you want right now would be smart.

Can you back this up? With quotes from prominent politicians? With statistics? I would like to see you do it- to actually prove something for a change, instead of just parroting received wisdom at us, pounding your fist on the table, and saying "This is true!" with a simplistic analogy or two thrown in to keep anyone from asking awkward questions.I will not dispute that taking on some debt for constructive purposes (e.g. infrastructure development, revitalize the nuclear power industry) would be OK, but there has to be a reasonable limit and I feel that exceeding 100% of the GDP is pushing it. That's like owing as much as you earn in salary, how can one feel financially comfortable with such a situation? There has to be a limit. You don't take on debt for everything in your daily life right? You only take on a mortgage for a home but not on a laptop purchase yes? The problem with the American economy is that it is taking out debt to fund everything under the sun, from SS to Food Stamps to Bailing out Banks to Expensive Wars, and it has the attitude of "I want everything" without due consideration on the long-term financial consequences of such actions.

This space dedicated to Vasily Arkhipov

- Terralthra

- Requiescat in Pace

- Posts: 4741

- Joined: 2007-10-05 09:55pm

- Location: San Francisco, California, United States

Re: Is a US economic implosion (aka Greece) inevitable?

Simon, it is also a misstatement to assert that we are just "paying off interest." Debt services on federal bills are not just interest, they are payments calculated to be the appropriate payment for the total balance of the bill with accumulated interest over the term of the bill.

- KrauserKrauser

- Sith Devotee

- Posts: 2633

- Joined: 2002-12-15 01:49am

- Location: Richmond, VA

Re: Is a US economic implosion (aka Greece) inevitable?

I owe many.times.more than my.salary. It's called a mortgage.

Debt is useful but the current rate of.debt accumulation versus our.current and future.growth rates appear to have us on an unsystainable.path.

I am more concerned.with the rate at which it is accumulating amd the.impact that an end of Fed.monetization will have on.our debt servicing costs. We likely will never be able become Japan as our savings rate is too low and we are forced to.sell.a.larger portion of our debt on the open market. As soon as the Fed ends.Operation Twist 2 Electric Boogaloo our rates are going to go.up and without further monetization ny the Fed the debt.servicing costs.are going to take.a.larger portion of government revenues.to meet. That could.lead.us.onto a true path of exponentual debt growth but we are still.a.while.away.from that.

Debt is useful but the current rate of.debt accumulation versus our.current and future.growth rates appear to have us on an unsystainable.path.

I am more concerned.with the rate at which it is accumulating amd the.impact that an end of Fed.monetization will have on.our debt servicing costs. We likely will never be able become Japan as our savings rate is too low and we are forced to.sell.a.larger portion of our debt on the open market. As soon as the Fed ends.Operation Twist 2 Electric Boogaloo our rates are going to go.up and without further monetization ny the Fed the debt.servicing costs.are going to take.a.larger portion of government revenues.to meet. That could.lead.us.onto a true path of exponentual debt growth but we are still.a.while.away.from that.

VRWC : Justice League : SDN Weight Watchers : BOTM : Former AYVB

Resident Magic the Gathering Guru : Recovering MMORPG Addict

Resident Magic the Gathering Guru : Recovering MMORPG Addict

-

Simon_Jester

- Emperor's Hand

- Posts: 30165

- Joined: 2009-05-23 07:29pm

Re: Is a US economic implosion (aka Greece) inevitable?

You're right.Terralthra wrote:Simon, it is also a misstatement to assert that we are just "paying off interest." Debt services on federal bills are not just interest, they are payments calculated to be the appropriate payment for the total balance of the bill with accumulated interest over the term of the bill.

On the other hand, this only makes the situation more favorable- debt service of the US national debt is such that we'd gradually pay off the debt anyway, as long as we stopped running up more debt. And balancing the budget, or getting close to it so that it will be balanced when times improve, really wouldn't be that hard... if the US could raise taxes.

This space dedicated to Vasily Arkhipov

Re: Is a US economic implosion (aka Greece) inevitable?

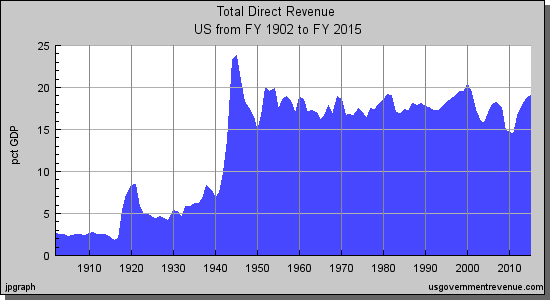

Except for the fact that the US has never been able to extract more than 20% of the GDP in tax revenues, with the exception of a couple years in WWII.Simon_Jester wrote:And balancing the budget, or getting close to it so that it will be balanced when times improve, really wouldn't be that hard... if the US could raise taxes.

No matter how you set your tax rates you get about 16-20% of GDP in tax revenues, it's like some unwritten rule of accounting and tax avoidance. So that pretty much caps the upper limit on the budget if you don't want to run deficits (as a sidenote, Canada was running a budget surplus when it had around 16-17% of GDP on tax revenues, so it can be done). I haven't looked at the healthcare & social security costs in a while so I could be a bit off, but as I recall they're going to eat up the entire federal budget in something like 20 years unless there's some serious reforms to get the costs under control. Unless you guys fix those biggies nothing else really matters, you can't have costs that compound at 8-10% per year in the case of healthcare and get away with it. The doubling time is 8 years on average, that is seriously bad shit and doesn't leave much time for you guys to fix things.

Lusankya: Deal!

Say, do you want it to be a threesome with your wife? Or a foursome with your wife and sister-in-law? I'm up for either.

-

Simon_Jester

- Emperor's Hand

- Posts: 30165

- Joined: 2009-05-23 07:29pm

Re: Is a US economic implosion (aka Greece) inevitable?

Eh, true.

Although if the political barriers to tax hikes were gone, the political barriers to things like reasonable controls on health care costs to bring them back in line with those of the rest of the developed would would probably go down with them.

Social security costs are less of a problem because they don't grow exponentially and we can see them coming- we know who will be drawing social security ten or twenty years from now, because they're all alive today.

Although if the political barriers to tax hikes were gone, the political barriers to things like reasonable controls on health care costs to bring them back in line with those of the rest of the developed would would probably go down with them.

Social security costs are less of a problem because they don't grow exponentially and we can see them coming- we know who will be drawing social security ten or twenty years from now, because they're all alive today.

This space dedicated to Vasily Arkhipov

- KrauserKrauser

- Sith Devotee

- Posts: 2633

- Joined: 2002-12-15 01:49am

- Location: Richmond, VA

Re: Is a US economic implosion (aka Greece) inevitable?

Hey, I know we can always just remove the income.cap.from FICA taxes and suddenly the.funding picture is.much brighter but the rich hold.the purse strings of the nation and would make Ebeneezer Scrooge say "Man, those guys are cheap."

VRWC : Justice League : SDN Weight Watchers : BOTM : Former AYVB

Resident Magic the Gathering Guru : Recovering MMORPG Addict

Resident Magic the Gathering Guru : Recovering MMORPG Addict

- bobalot

- Jedi Council Member

- Posts: 1728

- Joined: 2008-05-21 06:42am

- Location: Sydney, Australia

- Contact:

Re: Is a US economic implosion (aka Greece) inevitable?

The Canadian experience proves nothing of the sort. Canada paid down its debt and cut spending when the the entire world economy was undergoing an economy recovery after the early 90's recession. In particular, Canada biggest export partner's economy (the U.S) was booming. Canada also had its dollar devalued.J wrote:Austerity works, case in point, Canada in the late 80's to mid 90's. Austerity works when a nation is actually serious about it and enacts the measures in time.Next post, how this all relates to austerity, and why austerity is a self-defeating position, and why deficit spending actually improves your long term debt position while stuck in a liquidity trap.

As you can see below, increased exports were the main driver of GDP growth, which in turn increased revenues for the government and helped balanced the budget.

Canada offset its fiscal austerity by devaluing its dollar against its biggest trading partner, thus increasing exports significantly. The major driver for GDP growth was exports (see above). Canada used exports to cover up the losses in aggregate demand (from government cuts), using a booming trading partner and devalued currency.

Most of the trade in Europe is to other European nations. The countries with the Euro have no means to devalue their currency and all the countries are putting pressure on internal demand (private and government) are driving down consumption (thus crippling each others export industries).

If all these economies were to implement austerity policies, it is not going to repeat the Canadian experience of the late 90's.

"This statement, in its utterly clueless hubristic stupidity, cannot be improved upon. I merely quote it in admiration of its perfection." - Garibaldi

"Problem is, while the Germans have had many mea culpas and quite painfully dealt with their history, the South is still hellbent on painting themselves as the real victims. It gives them a special place in the history of assholes" - Covenant

"Over three million died fighting for the emperor, but when the war was over he pretended it was not his responsibility. What kind of man does that?'' - Saburo Sakai

Join SDN on Discord

"Problem is, while the Germans have had many mea culpas and quite painfully dealt with their history, the South is still hellbent on painting themselves as the real victims. It gives them a special place in the history of assholes" - Covenant

"Over three million died fighting for the emperor, but when the war was over he pretended it was not his responsibility. What kind of man does that?'' - Saburo Sakai

Join SDN on Discord

- UnderAGreySky

- Jedi Knight

- Posts: 641

- Joined: 2010-01-07 06:39pm

- Location: the land of tea and crumpets

Re: Is a US economic implosion (aka Greece) inevitable?

I beat you to this one, bobalot  (but you posted the pretty graphs, damn you!)

(but you posted the pretty graphs, damn you!)

The other school of thought, generally advanced by an economist named Scott Sumner, is called "Nominal GDP Targeting" Nominal GDP = GDP without taking inflation into account. From what I can tell it goes like this:

If your NGDP grows 5% and your inflation is 5%, your "real" GDP growth rate (which is what counts and is published) is zero. NGDP targeting says "print money as fast as you can till you hit a target". If the target is 4%, you don't care if it's 4% growth, 4% inflation, or 2% of each. If it's growth, it's good. If it's inflation, it forces those who are sitting on cash to invest them into projects because they will need anything to give them returns over what cash does.

NGDP targeteers (not to be confused with Stuart Slade... ) say that it won't ever get to the inflation stage because just the threat of targeting will get people to invest. Their analogy is...

) say that it won't ever get to the inflation stage because just the threat of targeting will get people to invest. Their analogy is...

There are two schools of thought on this: the Keynesians say at this point printing money won't help much because interest rates are near zero and extra money will just be holed up (and it seems they're right, QE2 did naff-all). But they do concede that at this moment, with wages not rising it won't hurt at least. Hyper-inflation, what RON PAUL and Peter Schiff keep fear-mongering about, is caused when wages and inflation chase each other and spiral out of control.AndroAsc wrote:would a better solution be to continue printing money

The other school of thought, generally advanced by an economist named Scott Sumner, is called "Nominal GDP Targeting" Nominal GDP = GDP without taking inflation into account. From what I can tell it goes like this:

If your NGDP grows 5% and your inflation is 5%, your "real" GDP growth rate (which is what counts and is published) is zero. NGDP targeting says "print money as fast as you can till you hit a target". If the target is 4%, you don't care if it's 4% growth, 4% inflation, or 2% of each. If it's growth, it's good. If it's inflation, it forces those who are sitting on cash to invest them into projects because they will need anything to give them returns over what cash does.

NGDP targeteers (not to be confused with Stuart Slade...

To which some wag pointed out, (paraphrasing) "that threat better be credible, else it will be the equivalent of moving a cardboard cutout of Chuck Norris into the room - not only will it not work but you'll get laughed at".There are two rooms at a party. The first room is nearly empty. The second room is nearly full. Because everyone wants to be where everyone else is. Then Chuck Norris enters the second room. He threatens to beat up 1 person at random in the first minute, 2 people in the second minute, 4 people in the third minute, and so on, until the room is empty. This is no longer an equilibrium.

A few people were nearly indifferent to being in the second room. So they leave even if the chance of them getting beaten up is tiny. That means there are fewer people left in the second room. This makes the second room slightly less attractive for those who want to be where everyone else is. And it slightly raises the probability of being beaten up by Chuck Norris. So more leave. Which repeats the process, so still more leave. And if you and I can see what's coming, so can the people in the room, who don't want to be the last to leave. There's a rush for the exits, and Chuck doesn't even have to lift a finger. OK, if someone didn't hear the threat, or doesn't recognise Chuck Norris, he might actually have to carry out his threat for a few minutes. But simply seeing all the others leave the room will be enough to induce most to leave the room very quickly.

Chuck Norris doesn't have to beat up everyone in the room. He just has to threaten to beat up as many as it takes to clear the room. The number of people he will actually beat up is a lot less than the number he threatens to beat up. If his threat is credible, and everyone hears it, he doesn't need to beat up anyone.

Eventually, if the Fed bought up every single asset in the economy, and swapped it for cash, NGDP would rise to the Fed's target path. Prices would rise without limit as the Fed bought up the last remaining assets because the sellers could name their price. And people would hire the unemployed to build factories which they could float on the stock and bond markets and sell to the Fed at any price they liked. Or sell to the people who had already sold all their assets to the Fed.

But there is no way it would ever get that far. That's like saying that Chuck Norris will eventually beat up everyone in the room. That's not an equilibrium.

Can't keep my eyes from the circling skies,

Tongue-tied and twisted, just an earth-bound misfit, I

Tongue-tied and twisted, just an earth-bound misfit, I

Re: Is a US economic implosion (aka Greece) inevitable?

I'll come back to the rest later when I have more time, but I'd like to know how they came up with those charts since the balance of trade for Canada has been positive for all the time periods which are listed. You can see this for yourself by entering the dates on this page.bobalot wrote:As you can see below, increased exports were the main driver of GDP growth, which in turn increased revenues for the government and helped balanced the budget.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

- Ariphaos

- Jedi Council Member

- Posts: 1739

- Joined: 2005-10-21 02:48am

- Location: Twin Cities, MN, USA

- Contact:

Re: Is a US economic implosion (aka Greece) inevitable?

Or you could just click over to the 'exports' link and see the explosive growth in exports during the 90's - from ~$10 billion to ~$40 billion per year. That some of that additional business revenue went to imports should shock no one.

Give fire to a man, and he will be warm for a day.

Set him on fire, and he will be warm for life.

Set him on fire, and he will be warm for life.

- bobalot

- Jedi Council Member

- Posts: 1728

- Joined: 2008-05-21 06:42am

- Location: Sydney, Australia

- Contact:

Re: Is a US economic implosion (aka Greece) inevitable?

Beat me to it.Xeriar wrote:Or you could just click over to the 'exports' link and see the explosive growth in exports during the 90's - from ~$10 billion to ~$40 billion per year. That some of that additional business revenue went to imports should shock no one.

Here is Canada's exports between January 1990 and January 2000.

Here is Canada's exchange rate to the US dollar between January 1990 and January 2000.

Here is Canada's budget year to year between January 1990 and January 2000.

"This statement, in its utterly clueless hubristic stupidity, cannot be improved upon. I merely quote it in admiration of its perfection." - Garibaldi

"Problem is, while the Germans have had many mea culpas and quite painfully dealt with their history, the South is still hellbent on painting themselves as the real victims. It gives them a special place in the history of assholes" - Covenant

"Over three million died fighting for the emperor, but when the war was over he pretended it was not his responsibility. What kind of man does that?'' - Saburo Sakai

Join SDN on Discord

"Problem is, while the Germans have had many mea culpas and quite painfully dealt with their history, the South is still hellbent on painting themselves as the real victims. It gives them a special place in the history of assholes" - Covenant

"Over three million died fighting for the emperor, but when the war was over he pretended it was not his responsibility. What kind of man does that?'' - Saburo Sakai

Join SDN on Discord

- bobalot

- Jedi Council Member

- Posts: 1728

- Joined: 2008-05-21 06:42am

- Location: Sydney, Australia

- Contact:

Re: Is a US economic implosion (aka Greece) inevitable?

On top of that, the worldwide economic recovery of the mid to late 1990's and Canada's export boom helped drive down unemployment which decreases the cost of providing welfare for the government while simultaneously increasing taxation revenues.

But don't worry! Every country in Europe can devalue their currency against their biggest trading partner, benefit from a worldwide economic recovery and export their way out of a recession! This austerity idea is brilliant!

But don't worry! Every country in Europe can devalue their currency against their biggest trading partner, benefit from a worldwide economic recovery and export their way out of a recession! This austerity idea is brilliant!

"This statement, in its utterly clueless hubristic stupidity, cannot be improved upon. I merely quote it in admiration of its perfection." - Garibaldi

"Problem is, while the Germans have had many mea culpas and quite painfully dealt with their history, the South is still hellbent on painting themselves as the real victims. It gives them a special place in the history of assholes" - Covenant

"Over three million died fighting for the emperor, but when the war was over he pretended it was not his responsibility. What kind of man does that?'' - Saburo Sakai

Join SDN on Discord

"Problem is, while the Germans have had many mea culpas and quite painfully dealt with their history, the South is still hellbent on painting themselves as the real victims. It gives them a special place in the history of assholes" - Covenant

"Over three million died fighting for the emperor, but when the war was over he pretended it was not his responsibility. What kind of man does that?'' - Saburo Sakai

Join SDN on Discord

- Darth Wong

- Sith Lord

- Posts: 70028

- Joined: 2002-07-03 12:25am

- Location: Toronto, Canada

- Contact:

Re: Is a US economic implosion (aka Greece) inevitable?

I don't see the contradiction. We exported more to the US and imported a lot of foreign-made goods with the resulting income.J wrote:I'll come back to the rest later when I have more time, but I'd like to know how they came up with those charts since the balance of trade for Canada has been positive for all the time periods which are listed. You can see this for yourself by entering the dates on this page.bobalot wrote:As you can see below, increased exports were the main driver of GDP growth, which in turn increased revenues for the government and helped balanced the budget.

The Canadian austerity miracle of the 1990s succeeded because the government had elbow room to do it. Today's governments do not have that elbow room. They used it all up in an asinine effort to keep a bubble going for as long as they could.

"you guys are fascinated with the use of those "rules of logic" to the extent that you don't really want to discussus anything."- GC

"I do not believe Russian Roulette is a stupid act" - Embracer of Darkness

"Viagra commercials appear to save lives" - tharkûn on US health care.

http://www.stardestroyer.net/Mike/RantMode/Blurbs.html

- KrauserKrauser

- Sith Devotee

- Posts: 2633

- Joined: 2002-12-15 01:49am

- Location: Richmond, VA

Re: Is a US economic implosion (aka Greece) inevitable?

So another fun factoid for anyone claiming "Inflation? What inflation?"

Average US Gasoline price today: $3.55 / gallon

Average US Gasoline price one year ago: $3.16 / gallon

(Basic unleaded, Source - AAA)

So I guess 12% inflation in our main energy source doesn't qualify as inflation. We must need more QE to juice the stock markets, inflation is apparently non-existent.

The Central Banks of the world are going to drive the economy over a cliff again in search of another bubble. Too bad they don't allow for jail time for reckless monetary policy.

Average US Gasoline price today: $3.55 / gallon

Average US Gasoline price one year ago: $3.16 / gallon

(Basic unleaded, Source - AAA)

So I guess 12% inflation in our main energy source doesn't qualify as inflation. We must need more QE to juice the stock markets, inflation is apparently non-existent.

The Central Banks of the world are going to drive the economy over a cliff again in search of another bubble. Too bad they don't allow for jail time for reckless monetary policy.

VRWC : Justice League : SDN Weight Watchers : BOTM : Former AYVB

Resident Magic the Gathering Guru : Recovering MMORPG Addict

Resident Magic the Gathering Guru : Recovering MMORPG Addict

- Terralthra

- Requiescat in Pace

- Posts: 4741

- Joined: 2007-10-05 09:55pm

- Location: San Francisco, California, United States

Re: Is a US economic implosion (aka Greece) inevitable?

Average gas price in June 2008: $4.15.

You can't just pick one commodity out of a hat and say "aha! there's inflation!" Commodity prices vary over time, and don't necessarily imply anything about the underlying strength of the currency.

Edit: gasoline, in particular, is a product with growing demand and a finite supply. Of course the price goes up over time.

You can't just pick one commodity out of a hat and say "aha! there's inflation!" Commodity prices vary over time, and don't necessarily imply anything about the underlying strength of the currency.

Edit: gasoline, in particular, is a product with growing demand and a finite supply. Of course the price goes up over time.

- K. A. Pital

- Glamorous Commie

- Posts: 20813

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: Is a US economic implosion (aka Greece) inevitable?

You don't get to arbitrarily exclude products like food or fuel from inflation figures, though, otherwise your inflation figures are a lie, and nothing but a tool of obfuscation.Edit: gasoline, in particular, is a product with growing demand and a finite supply. Of course the price goes up over time.

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali

- Terralthra

- Requiescat in Pace

- Posts: 4741

- Joined: 2007-10-05 09:55pm

- Location: San Francisco, California, United States

Re: Is a US economic implosion (aka Greece) inevitable?

Absolutely, that is true. That's why the BLS uses a "basket" composite of goods roughly corresponding to the average family's consumption to estimate inflation, and that includes foodstuffs and fuel prices. It's called the consumer price index, and the CPI currently estimates year over year inflation from 2011-2012 at 1%. See the BLS's methodology for the exact details.Stas Bush wrote:You don't get to arbitrarily exclude products like food or fuel from inflation figures, though, otherwise your inflation figures are a lie, and nothing but a tool of obfuscation.Edit: gasoline, in particular, is a product with growing demand and a finite supply. Of course the price goes up over time.

- K. A. Pital

- Glamorous Commie

- Posts: 20813

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: Is a US economic implosion (aka Greece) inevitable?

Yup, I know that the CPI (unlike stuff like "Core CPI", for example) uses all of the goods available. I might disagree with some of the weights (now that I had a look at the table a the end of the file) as excessively favoring an upper-class consumption pattern and a low weight of first-order consumable products, but I'm not arguing against the CPI par se.

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali

- KrauserKrauser

- Sith Devotee

- Posts: 2633

- Joined: 2002-12-15 01:49am

- Location: Richmond, VA

Re: Is a US economic implosion (aka Greece) inevitable?

Why use the June 2008 number as a comparison? June is at the height of the seasonal gas prices. February 2008 average gas prices? $3.04 / gallon, we're almost 20% higher than that now.

Also June 2008 we were in about the same place in the news cycle. Everyone was sure everything was going to be ok, no oncoming recession, housing was going to come back.

That is possibly the worst time to refer to possible, the country was in complete denial of what was coming, just like we are now.

At this rate we might see $4.83 / gallon gas if we see the same intra year growth as we did in 2008. In your mind this will do good things for the economy? No, it will wreck it and usher in a new recession most likely as discretionary spending will be destroyed.

I choose gas because each time gas has breached $4 the US economy has started to stutter. If we are going to breach 2008 gas prices with an economy on life support, what alien world are you expecting will bail us out to fund the debt required to grow our way out of the inevitable recession that will follow?

Also June 2008 we were in about the same place in the news cycle. Everyone was sure everything was going to be ok, no oncoming recession, housing was going to come back.

That is possibly the worst time to refer to possible, the country was in complete denial of what was coming, just like we are now.

At this rate we might see $4.83 / gallon gas if we see the same intra year growth as we did in 2008. In your mind this will do good things for the economy? No, it will wreck it and usher in a new recession most likely as discretionary spending will be destroyed.

I choose gas because each time gas has breached $4 the US economy has started to stutter. If we are going to breach 2008 gas prices with an economy on life support, what alien world are you expecting will bail us out to fund the debt required to grow our way out of the inevitable recession that will follow?

VRWC : Justice League : SDN Weight Watchers : BOTM : Former AYVB

Resident Magic the Gathering Guru : Recovering MMORPG Addict

Resident Magic the Gathering Guru : Recovering MMORPG Addict

- UnderAGreySky

- Jedi Knight

- Posts: 641

- Joined: 2010-01-07 06:39pm

- Location: the land of tea and crumpets

Re: Is a US economic implosion (aka Greece) inevitable?

The same world that is willing pay the US to keep its money today for short duration (in inflation-adjusted terms).

No one is claiming there is no inflation at all. No one is claiming that gas prices don't affect the economy. What we disagree about is that it's all doom doom doom if the price hits $4/gal.

No one is claiming there is no inflation at all. No one is claiming that gas prices don't affect the economy. What we disagree about is that it's all doom doom doom if the price hits $4/gal.

Can't keep my eyes from the circling skies,

Tongue-tied and twisted, just an earth-bound misfit, I

Tongue-tied and twisted, just an earth-bound misfit, I

- Terralthra

- Requiescat in Pace

- Posts: 4741

- Joined: 2007-10-05 09:55pm

- Location: San Francisco, California, United States

Re: Is a US economic implosion (aka Greece) inevitable?

Why, it's almost like gasoline is a commodity with an extremely volatile price, and thus a terrible gauge of inflation!KrauserKrauser wrote:Why use the June 2008 number as a comparison? June is at the height of the seasonal gas prices. February 2008 average gas prices? $3.04 / gallon, we're almost 20% higher than that now.

-

Simon_Jester

- Emperor's Hand

- Posts: 30165

- Joined: 2009-05-23 07:29pm

Re: Is a US economic implosion (aka Greece) inevitable?

Krauser, a 20% increase in the price of gasoline isn't 20% inflation. Not unless you eat gasoline, drink gasoline, treat your injuries with gasoline, live in a house made of gasoline, wear gasoline clothes, send your kids to Gasoline University, and work on a gasoline computer.

This space dedicated to Vasily Arkhipov